Crasher of Keynesian Economics

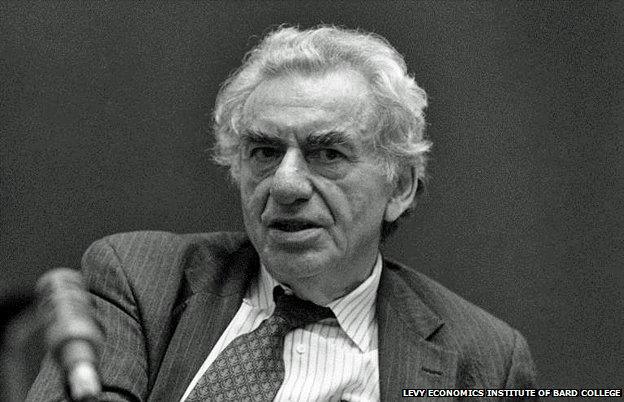

Hyman Philip Minsky was born on September 23, 1919, in Chicago, Illinois, USA. He studied economics at the University of Chicago, where he was influenced by the institutionalist tradition, before earning his PhD from Harvard University in 1954 under the supervision of Joseph Schumpeter and Wassily Leontief. Throughout his career, Minsky sought to understand financial instability and the inherent fragility of capitalist economies, distinguishing himself as one of the most important heterodox Keynesian economists.

Minsky’s most influential contribution was his Financial Instability Hypothesis (FIH), which argued that financial markets are inherently unstable due to endogenous cycles of speculative booms and busts. He identified three types of financing regimes: hedge finance, where firms can meet all their debt obligations from cash flow; speculative finance, where firms must roll over debt because they cannot cover principal repayments; and Ponzi finance, where firms rely on rising asset prices to refinance debt, making the system highly vulnerable to collapse. According to Minsky, prolonged periods of economic stability lead to increasing risk-taking, eventually resulting in financial crises—a pattern often summarized as “stability breeds instability.”

Minsky’s work was largely overlooked during his lifetime, as mainstream economics favored models assuming market efficiency and rational expectations. However, following the 2008 financial crisis, interest in his ideas surged, with many economists and policymakers recognizing the relevance of his warnings about financial system fragility. The term “Minsky Moment”—popularized by economists and financial analysts—describes the sudden market collapse that follows excessive speculative borrowing and asset inflation, exemplified by the 2008 crash.

His major works include John Maynard Keynes (1975), where he reinterpreted Keynes’s theories through a financial lens, and Stabilizing an Unstable Economy (1986), in which he argued for government intervention to prevent financial excesses and crashes. Minsky’s ideas have strongly influenced post-Keynesian economics, particularly in areas of financial regulation, banking, and macroeconomic stability.

Minsky spent much of his academic career at Washington University in St. Louis, where he was a professor for over 25 years. He was also a distinguished scholar at the Levy Economics Institute, where he further developed his ideas on financial instability. He passed away on October 24, 1996, in Rhinebeck, New York. Today, Minsky’s insights remain highly relevant in discussions on financial crises, economic cycles, and the role of government in stabilizing capitalist economies.