Monetarist of NeoClassical Economics

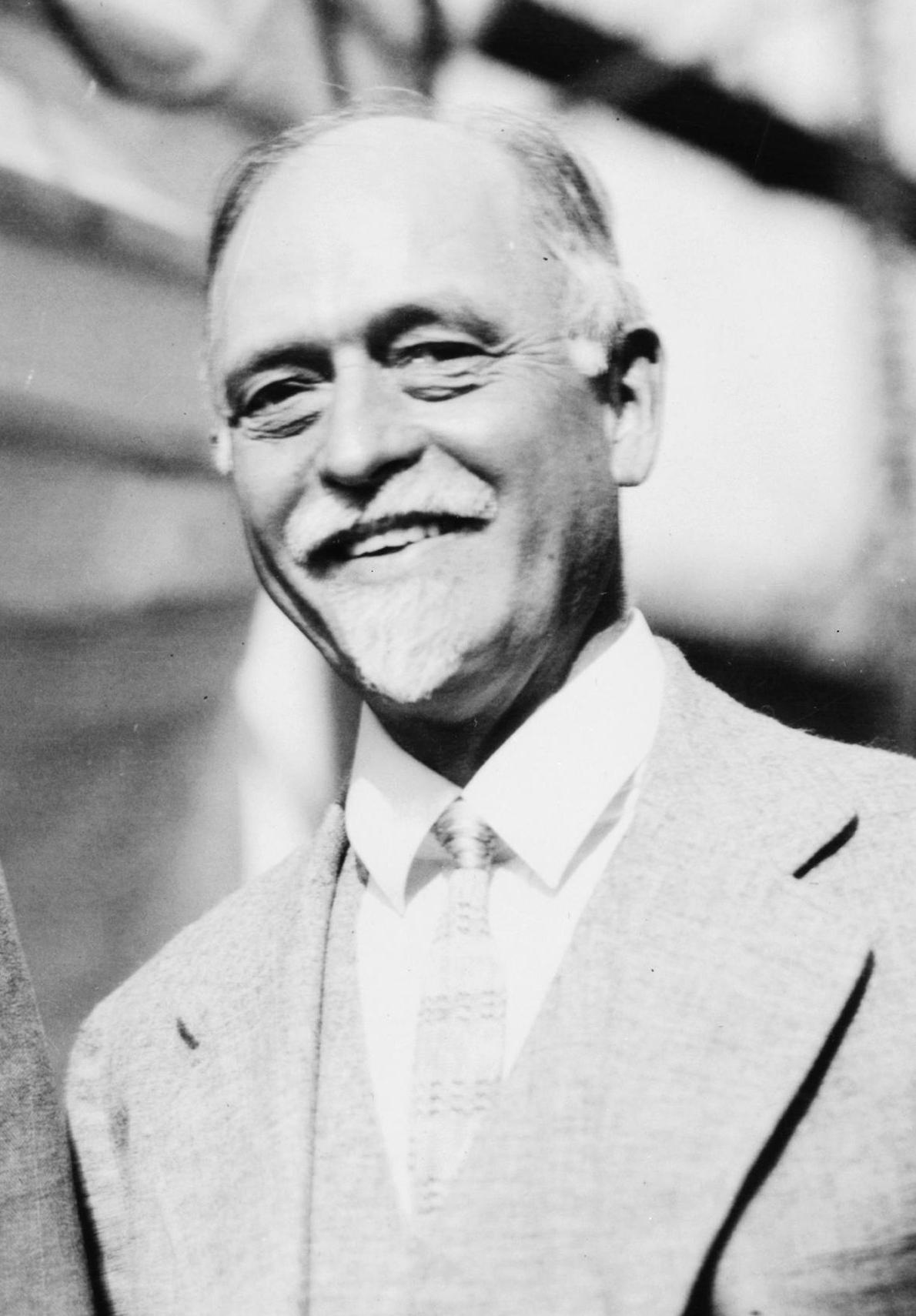

Irving Fisher was born on February 27, 1867, in Saugerties, New York. Initially trained in mathematics at Yale University, he became one of the first American economists to apply mathematical rigor to economic theory. His work laid the foundation for monetary theory, interest rate analysis, and inflation measurement, making him one of the most influential economists of the early 20th century.

Fisher’s most significant contribution was his development of the quantity theory of money, which he formalized in his famous Equation of Exchange: MV=PTMV = PTMV=PT

where M is the money supply, V is the velocity of money, P is the price level, and T represents real transactions. This equation explained the relationship between money supply and inflation, influencing later monetarist economists, including Milton Friedman. Fisher argued that changes in money supply directly impact price levels, making monetary policy crucial in stabilizing the economy.

In his book The Theory of Interest (1930), Fisher introduced the Fisher equation, which describes the relationship between nominal interest rates, real interest rates, and inflation expectations. This insight became fundamental in modern macroeconomics and financial economics, shaping how central banks set interest rates.

Fisher also developed the concept of intertemporal choice, explaining how individuals make consumption and saving decisions over time. His theory influenced later models in behavioral economics and finance, particularly in understanding investment decisions and capital markets.

Beyond monetary theory, Fisher was a pioneer in statistical economics. He contributed to early econometrics and developed innovative price index methods, which led to more accurate measurements of inflation and economic activity. His work helped shape how governments and financial institutions track economic performance.

Despite his academic brilliance, Fisher is often remembered for his infamous prediction before the Great Depression, stating in 1929 that stock prices had reached a “permanently high plateau.” The 1929 stock market crash and ensuing Great Depression severely damaged his reputation, though his theoretical contributions remained highly influential.

Fisher was also a strong advocate for public health and economic reform. He championed Prohibition, eugenics, and progressive economic policies, though some of his social ideas became controversial over time. His later work focused on promoting monetary stability, particularly through proposals for 100% reserve banking, which aimed to prevent financial crises by restricting banks’ ability to create money.

Irving Fisher passed away on April 29, 1947, but his legacy endures. His work on monetary theory, interest rates, inflation, and intertemporal choice remains central to economic thought, influencing both monetarist and Keynesian economists. His theories continue to shape modern central banking, financial regulation, and macroeconomic policy.